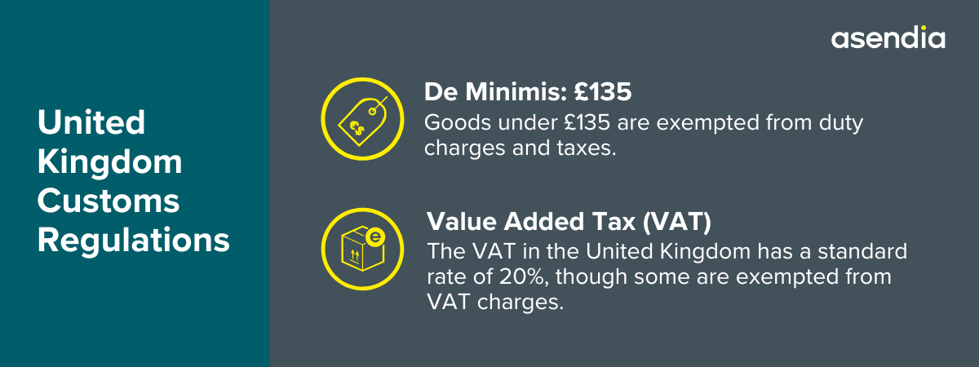

Customs Regulations Overview in the United Kingdom

When expanding your business into the UK, understanding the country's customs regulations is essential for a smooth import process. Her Majesty’s Revenue and Customs (HMRC) sets the de minimis threshold for imports at £135. So, if your shipment’s value is under £135 and not subject to excise tax or duties, you won’t face import duties. However, if the value exceeds £135, import duties will apply based on the specific product category. It’s important to note that goods subject to excise duties or taxes are not eligible for the de minimis exemption, regardless of their value.

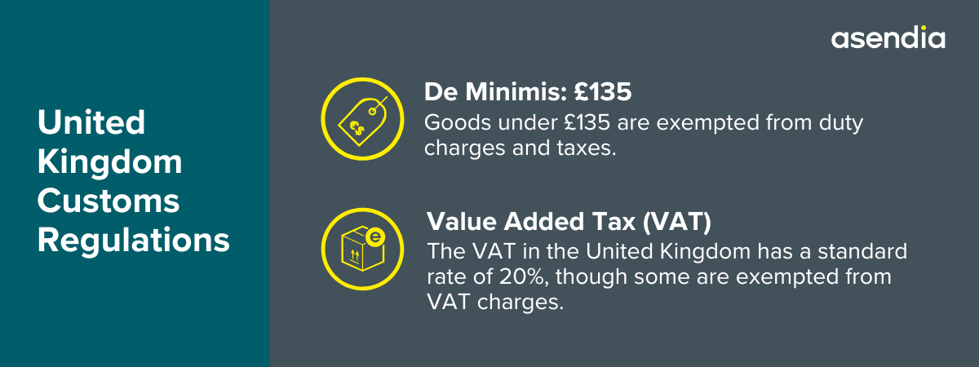

In addition, the UK applies a standard VAT rate of 20%, though some goods may be exempt. To learn more about VAT exemptions and rates, visit the UK Government official website.

Required Customs Documents

Before importing into the UK, you must obtain an EORI (Economic Operators Registration and Identification) number from HMRC. You’ll also need to submit an import declaration through either the Customs Handling of Import and Export Freight (CHIEF) system or the updated Customs Declaration Service (CDS). For a more detailed guide, be sure to check out the UK Government’s website on how to import into the UK.

There are also a few customs documents that you need to prepare before importing goods into the UK:

1. Commercial Invoice

The commercial invoice is usually used to determine the true value of goods when assessing customs duties.

2. Packing List

A packing list is a document that confirms the items detailed in the commercial invoice, along with information about how the shipment is packed. It typically includes details such as the invoice number, shipment date, shipping method, carrier, package type, and other pertinent information.

3. Bill of Lading or Airway Bill

Depending on the mode of transport, you will need to either provide an airway bill for air and ground shipment, or a bill of lading for sea, train, and truck shipments.

4. Certificate of Origin (COO)

The COO is generally used to confirm the country where the products in an export shipment were manufactured, processed, or produced. It usually contains information such as:

- Description of the goods

- Country of origin

- Exporter information

- Signature and stamp of the issuing authority

5. Insurance Certificate

The insurance certificate demonstrates that your shipment is covered against possible loss or damage while in transit. While it may not always be mandatory, it’s crucial for safeguarding your investment and ensuring any claims can be handled smoothly.

6. Importer's EORI Number

All businesses importing goods into the UK are required to have an EORI number. Customs authorities use this number to track and manage your shipments. Make sure to include your EORI number on all necessary documentation.

7. Dangerous Goods Declaration (DGD)

If your shipment consists of dangerous goods, you need to fill up a form to declare.

8. Import/Export License

You need to obtain an EORI as mentioned earlier on this page. To find out more, please visit the guide on how to import goods into the UK.

9. IPAFFS Health Certificate

The IPAFFS Health Certificate is required to approve specific goods from EU and non-EU countries. The following products must be notified in advance through the IPAFFS:

- Live animals

- Germinal products

- Animal by-products

- High-risk food and feed not of animal origin (HRFNAO)

- Products of animal origin (POAO)

- Composite food products

- Plants and plant products

For more information about the IPAFFS, including how to register, see the government's website here.

.jpg?width=2000&name=pexels-karolina-grabowska-5237646%20(1).jpg)

.jpg?width=2000&name=pexels-cottonbro-5076516%20(1).jpg)

.png?width=1972&height=1173&name=DE_Blog_Payment-trends%20(1).png)

.jpg?width=2000&name=pexels-ron-lach-7801874%20(1).jpg)